Direct Investing

Program Related Investments

System change requires bold, creative, nontraditional funding responses

Program related investments enable AJL to invest directly in both nonprofit and for-profit organizations that support families and youth in a variety of ways and generate at or below-market returns. The funds are then returned and recycled back out into the community. AJL is dedicating up to 10% of our portfolio - approximately $1.5 million - to PRIs. More information on the PRI process can be found here. If your organization is interested in discussing a PRI opportunity, please reach out to Alece Montez at amontez@ajlfoundation.org.

Program Related Investment: Loan

Street Fraternity

The Challenge: Street Fraternity was located in the basement of the Disabled American Veterans building and needed room to expand their services. Serving Denver's urban young men, many of whom are experiencing economic hardships, have trauma from their homelands, struggle with street violence, and lack education and opportunity in general, Street Fraternity is working to address the growing needs they see daily. The challenge, they also needed a financially sustainable way to ensure their work could continue.

The Opportunity: AJL made a $100,000 loan @ 0% over 7 years to Street Fraternity to support remodeling their existing location and expand services for the East Colfax community. Street Fraternity is a safe refuge of brotherhood and offers a space for growth and healing.

The Impact: Shore up Street Fraternity's ability to generate rental income while providing affordable rent to nonprofits that align with the wraparound services for young men ages 14-25.

Program Related Investment: Loan

Thriving Families

The Challenge: In 2016, Thriving Families started MotherWise, an evidence-based program for pregnant and postpartum people, in a waiting room at Denver Health. It was their first program and it was a success, but they quickly learned from the families they served about additional needs they had. Thriving Families has expanded exponentially since then and needed a larger space to house more services and supports

The Opportunity: AJL made a $100,000 loan @ 0% over 7 years to Thriving Families to support with the purchase and remodeling of a new location.

The Impact: Contribute toward Thriving Families goal to serve upwards of 1,000 families a year, more programs and services such as a social enterprise, job training, commercial kitchen, childcare center, and more. By making a program related investment (loan), AJL will benefit by seeing an increase in our community impact and ESG scores.

Program Related Investment: Loan

The Equity Project LLC

The Challenge: The COVID-19 pandemic and global uprising against racism have illuminated the deep level of inequities within both organizations and communities, and demonstrated how it’s affecting everyone but more so historically marginalized communities. This is a critical time in history to examine the sources and impacts of inequity, and make changes to move communities, organizations and systems toward equitable outcomes.

The Opportunity: AJL made a $100,000 low interest loan @ 2% over 10 years to The Equity Project LLC to support expanding, deepening and advancing equity within Colorado’s businesses, government, nonprofits and communities.

The Impact: Contribute to creating equitable programs, processes and outcomes within Colorado’s communities, nonprofits, governments and corporations which will result in: equitable access to opportunities, experiences and income for women and people of color, which results in increased job and life satisfaction and increased income for individuals and their families.

Program Related Investment: Loan

Muslim Youth for Positive Impact

The Challenge: Muslim Youth for Positive Impact (MYPI) has a mission to empower youth with the Islamic identity and principles to make a positive impact on their communities, environment and relationships that promote responsible citizenship and stewardship. MYPI had the opportunity to purchase their own building (versus renting office space) but needed additional funding for expenses, repairs and renovations.

The Opportunity: AJL issued a $200,000 loan @ 0% interest over 10 years to support expenses, repairs and renovations related to the purchase of MYPI's new building.

The Impact: AJL’s loan will support expenses, repairs and renovations for MYPI's permanent home through which they can expand their reach, deepen their programs, and ensure long-term sustainability for their community. AJL can uniquely support MYPI by offering a no-interest loan, which is a cultural requirement of their faith (they cannot pay interest). By offering longer terms with deferred payments, AJL’s loan can ease financial pressures and contribute to the likelihood of their success with flexible terms.

Program Related Investment: Private Equity

Knotty Tie Co.

THE CHALLENGE: Knotty Tie Co. is a mission-driven company that employs refugees to make custom, handmade ties and scarves using sustainable fabrics and an eco-friendly process. They pay their employees a living wage and provide benefits and opportunities for growth enabling employees to support their families. The COVID-19 pandemic caused a significant loss of sales and if no changes were made, Knotty Tie Co. would have had to close their doors and lay off staff. COVID-19 also left Colorado, and the nation, facing a shortage of face masks for people during a pandemic-level viral outbreak that is overwhelming our healthcare system.

THE OPPORTUNITY: AJL made a $75,000 equity investment in Knotty Tie Co. which enabled the company to avoid closing and shift to manufacturing reusable, washable face masks for Coloradans affected by the COVID-19 pandemic.

THE IMPACT: 1) Knotty Tie Co. continued operations and generated revenue to keep staff employed through the COVID-19 crisis, 2) Knotty Tie Co. can manufacture 500+ reusable, washable face masks per day to help address the shortage and protect individuals affected by the COVID-19 pandemic, 3) Additional product line was created which could potentially generate future revenue 4) An equity investment provided cash for growth immediately and to save their mission, instead of a loan restricting cash flow. As they are growing, they have room to continue to invest cash savings from debt payments back to growth, which in turn grows their mission and impact, 5) AJL has potential for upside and recoup, and this investment also boosts Knotty Tie Co.’s credibility as a social enterprise which increases chances for future impact-oriented Series A funding. Read more about this investment here.

Program Related Investment: Loan

SistahBiz Loan Fund

The Challenge: Sistahbiz Global Network provides affordable options for coaching, training and services to help Black women grow, succeed and play big in business, but despite having investment-ready businesses at graduation, many Sistahbiz clients are denied small business loans or venture capital funding due to deeply embedded systemic bias and barriers to accessing capital.

The Opportunity: AJL issued a low-interest loan of $100,000 at 2% interest over 8 years to seed the Sistahbiz Loan Fund, the first loan fund dedicated to Black women entrepreneurs in the nation, to provide small business loans.

The Impact: 1) Black women entrepreneurs in Colorado have access to small business loans ranging from $500 to $50,000 at 7% - 12% interest over 5 years, 2) early commitment to the fund of $250,000 with the goal to reach $1M in year 1 and 3) an opportunity to raise awareness and directly address systemic bias and barriers in our financial systems both nationally and locally in Colorado. Read more about this investment here.

Update: The $100,000 loan (as well as additional loan funds from 6 other investors) were modified into a SAFE agreement so that the funds could be used to issue an equity investment in Sistahbiz LLC. This is a fairly innovative investment structure that will allow Sistahbiz to further expand services and increase impact-alignment with the original mission.

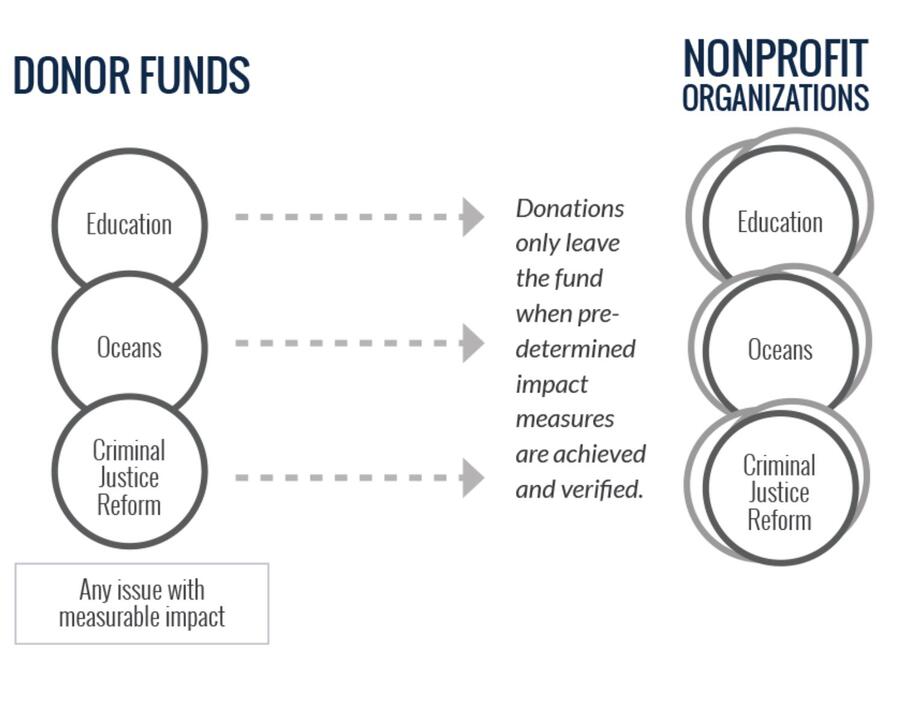

Program Related Investment: Impact Securities

NPX and CrossPurpose

The Challenge: CrossPurpose is a non-profit organization abolishing relational, economic, and spiritual poverty through career and community development. NPX aims to transform the way impact is financed in the nonprofit sector. NPX has pioneered the first private pay-for-success donation impact fund (DIF) that releases donations based on results. Traditional or “public” pay-for-success models such as social impact bonds have been used by innovative governments around the world, but to date few private philanthropists have used the model to make performance-based donations. CrossPurpose is one of the chosen beneficiaries of the donor impact fund (DIF).

The Opportunity: AJL purchased $100,000 worth of impact securities which matured on March 31, 2023, and based on the impact achieved by CrossPurpose, resulted in 6% return on investment.

The Impact: AJL’s investment supported a cohort of 50 people to lift themselves out of poverty through a proven career and community development program and aid in piloting an innovative pay-for-success/impact funding model that can be applied more broadly across the nonprofit sector if proven successful.

Program Related Investment: Loan

CASA of the 7th Judicial District

The Challenge: CASA of the 7th Judicial District was facing increased rent on space they had outgrown, and it made more financial sense to purchase an office building. However, CASA had recently completed a capital campaign to raise money to build affordable housing units for youth aging out of foster care. Their donors were tapped, and with the small down payment they could afford, they were not getting great terms from the lender for a mortgage.

The Opportunity: AJL partnered with CASA to make a low interest loan of $100,000 @ 2% interest over 10 years for a down payment to purchase a building.

The Impact: CASA was able to 1) show a lower debt/equity ratio on the purchase which resulted in a better interest rate from traditional lenders, 2) save approximately $60,000 in interest over the life of the mortgage, 3) secure a building that allowed them to enhance services, create a resource center and job training for youth and generate revenue. Read more about this investment here.

Program Related Investment: Guarantee

PPP Credit Facility

The Challenge: Many of Colorado's small businesses and nonprofits were left out of the first round of the Small Business Administration's Paycheck Protection Program funding amid an economic crisis. Their applications were backlogged with three nonprofit lenders who didn't have the liquidity to access the second round of PPP funding.

The Opportunity: AJL leveraged our balance sheet by guaranteeing $500,000, a portion of a loan to be made by FirstBank to the nonprofit lenders, pending foundation loan guarantees.

The Impact: AJL joined the Gates Family Foundation ($5M), Gary Community Investments ($5M) and the Colorado Office of Economic Development and International Trade ($2M) to guarantee a total of $12.5M to Colorado Enterprise Fund, DreamSpring and Colorado Lending Source, enabling them to secure PPP funding and provide to local small businesses and nonprofits who would not have otherwise had access to this funding in an economic crisis. Read more about this investment here.